30+ How much will mortgage lend me

Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. A typical mortgage length is 25 years.

Spvq7qbaxasghm

The traditional way to work out how much a bank will lend is to multiply a person or couples salary by 45 although lenders will often push this to the limit in order to lend.

. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Are assessing your financial stability ahead of.

The traditional way to work out how much a bank will lend is to multiply a person or couples salary by 45 although lenders will often push this to the limit in order to lend depending on. Lenders have a certain threshold they arent willing to cross. If you want a more accurate quote use our affordability calculator.

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. This mortgage calculator will show how much you can afford. The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. How much can I borrow.

Ad More Veterans Than Ever are Buying with 0 Down. Under this particular formula a person that is earning. For example a 30-year fixed mortgage would have 360.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Youll pay a total of 18291055 in interest costs with a full 30-year fixed mortgage.

This is what the lender charges you to lend you the money. Interest rate The bigger your deposit the better the. 2049 lakh an interest rate of.

So if you earn 30000 per year and the lender will lend four times. But if you take a 20-year fixed-rate term it will be reduced to 11082778 which saves 7208277 in interest. They were able to complete a cash-out refi and close on a new purchase investment property for me in about 30 days.

Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. If you dont know how much. Your monthly recurring debt.

The first step in buying a house is determining your budget. Interest rates are expressed as an annual percentage. These monthly expenses include property taxes PMI association.

Fill in the entry fields and click on the View Report button to see a. Estimate Your Monthly Payment Today. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

The length by which you agree to pay back the home loan. Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow. For this reason our calculator uses your.

Your annual income before taxes The mortgage term youll be seeking. Want to know exactly how much you can safely borrow from your mortgage lender. For example a person who is 30 years old and earns a gross monthly salary of 30000 rupees is eligible for a loan with a principal amount of Rs.

At the end of the. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. The Maximum Mortgage Calculator is most useful if you.

The interest rate youre likely to earn. The longer your term the less you may pay each month but youll end up paying more in interest. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

For instance if you take on a mortgage loan that results in a total debt-to-income ratio of only 30 youre probably in good.

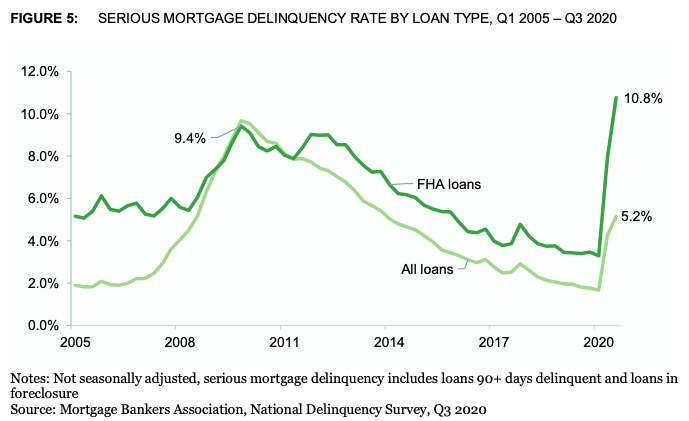

Nope Auto Loan Delinquencies And Repos Are Not Exploding They Rose From Record Lows And Are Still Historically Low Wolf Street

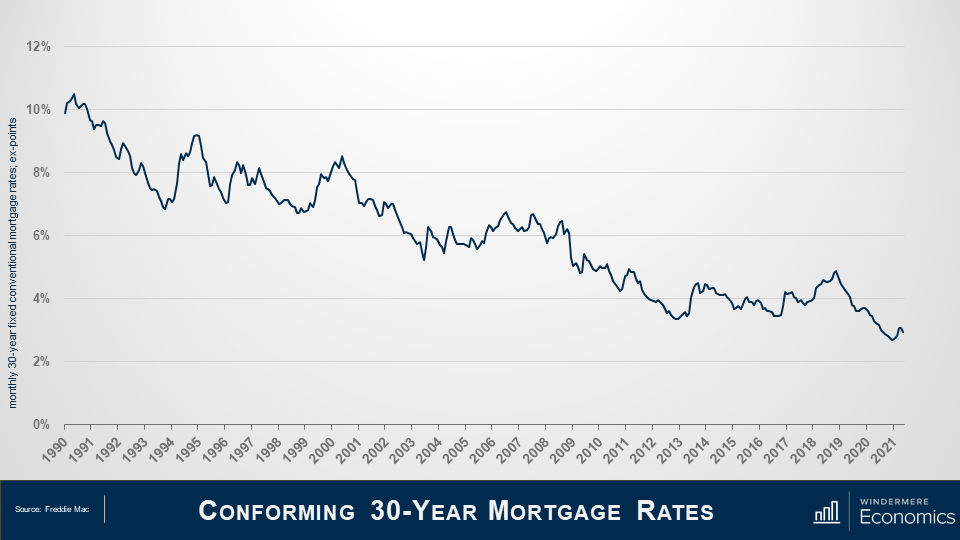

6 28 21 Housing And Economic Update From Matthew Gardner Windermere Real Estate

Airbnb Rental Income Statement Tracker Monthly Annual Etsy Airbnb Rentals Rental Income Rental Property Management

Should You Pay Off A Mortgage Early Part Ii Charts And Graphs

A Refinance Opportunity Has Emerged Mortgage Rates Have Declined

Pin By Michelle Sherman On Financial In 2022 Money Management Advice Saving Money Budget Financial Life Hacks

A Refinance Opportunity Has Emerged Mortgage Rates Have Declined

Buyers Strike Mortgage Applications Drop 8 Below 2019 As Home Buyers Get Second Thoughts About Raging Mania Wolf Street

Home Loans St Louis Real Estate News

How Would The Federal Tapering Affect Me Economy Infographic Mortgage Interest Rates Mortgage Payoff

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Flowchart Examples With Guide Tips And Templates Good Boss Management Skills Leadership Leadership Skills

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Loan Officer Marketing Plan Template Awesome Loan Ficer Business Plan Template Sample Marketing Plan Template Marketing Plan How To Plan

Quintessential Mortgage Group On Instagram Gina Ferri Has Been A Certified Public Accountant For Over 25 Ye Certified Public Accountant Loan Officer Mortgage